Energy Update

Five hydropower companies receive SEBON’s approval to issue IPOs of Rs 4.14 billion

Kathmandu: The Securities Board of Nepal (SEBON) has permitted five hydropower companies to issue 41.40 million units of their primary shares.

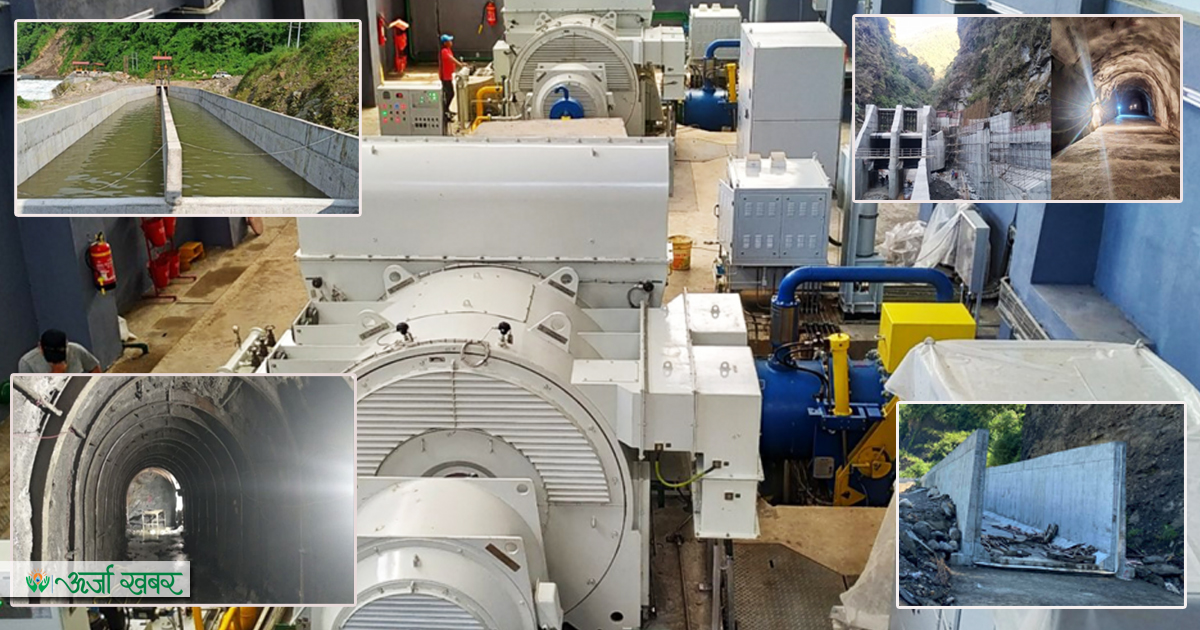

According to the SEBON, Asian Hydropower, Supermai Hydropower, Super Madi Hydropower, Maya Khola Hydropower and Shuvam Power have recently received approval from the regulator to float the initial public offerings (IPOs). These hydropower companies will issue IPOs worth Rs 4.14 billion for migrant workers, people from project-affected areas and general people.

Asian Hydropower is floating IPOs of Rs 340 million, which is 34.71 percent of its paid-up capital. It has appointed NMB Capital as its issue manager.

Supermai Hydropower will be issuing IPOs worth Rs 500 million, 20 percent of its paid-up capital. Sanima Capital will work as the issue manager for Supermai.

Super Madi Hydropower will be issuing its IPOs worth Rs 2.1 billion, which makes 15 percent of the company’s paid-up capital. Sanima Capital will work as the issue manager for Super Madi.

Maya Khola Hydropower has received approval to issue IPOs of Rs 1 billion, which is 34 percent of the company’s paid-up. The hydropower company has appointed Prabhu Capital as the issue manager.

Likewise, Shuvam Power has been permitted to float IPOs of Rs 200 million that will make 29.029 percent of the company’s paid-up. Muktinath Capital will perform the role of issue manager for the hydropower company.

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]