Energy Update

Nabil Bank unveils study report on GHG emission of its funded projects

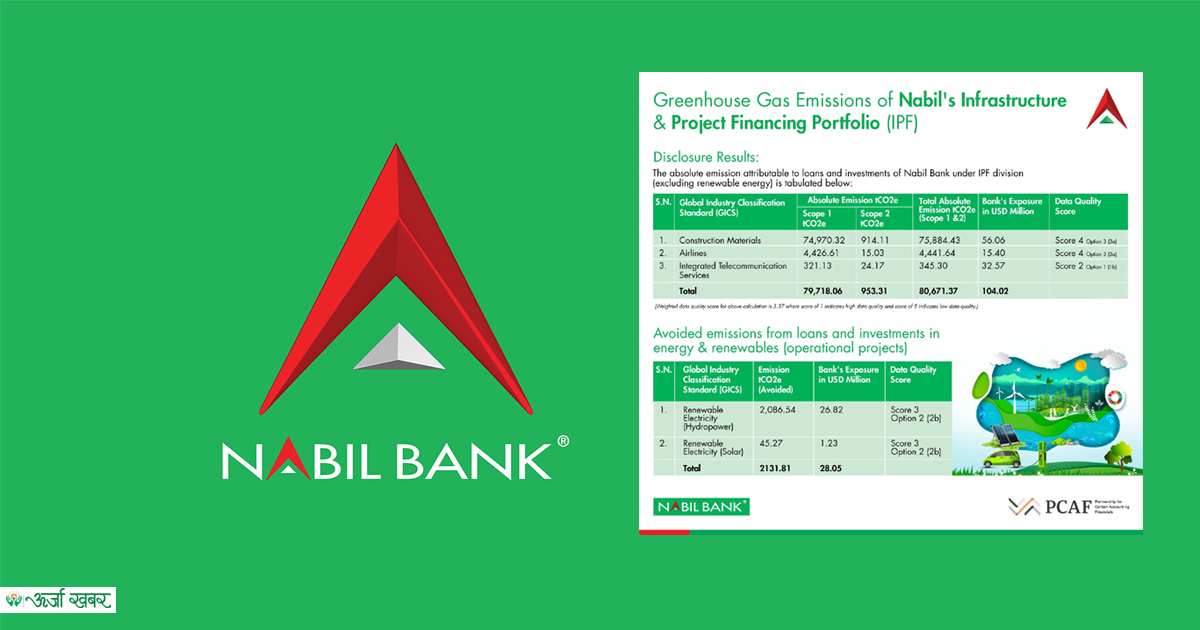

KATHMANDU: Nabil Bank has made public its study report on greenhouse gas (GHG) emissions out of the projects financed by the bank’s loan and investments portfolio, under Infrastructure and Project Financing (IPF) division, in 2022.

Nabil Bank has come up with the initiative as a part of a commitment letter that it signed under the Partnership for Carbon Accounting Financials (PCAF) signatories in 2021. The bank’s IPF portfolio includes a range of investments and loans to business sectors like energy, cement, airlines and telecommunication services.

The Sustainable Banking vertical of the bank had set out to measure emissions from the bank’s loan and investments portfolio under the IPF division. The assessment of the portfolio’s carbon emissions revealed that the total emissions for 2022 stood at around 80,671.37 tons of carbon dioxide.

Similarly, the bank’s investment in hydro and solar helped reduce carbon-dioxide emissions by 2131.81 tons. “While this is a significant amount, we are actively working to reduce our carbon footprint and make our portfolio more sustainable,” said Gyanendra Prasad Dhungana, CEO of Nabil Bank.

Stating that Nabil Bank is dedicated to building a sustainable future, Dhungana added they recognize the need for a collective action for the purpose. “We believe transparency is essential in achieving our goals, as we are committed to providing regular updates on our progress towards a net-zero carbon footprint.”

Nabil Bank, being the first private sector bank in Nepal, has pioneered financial service innovations and sustainability in the banking industry. The sustainable banking unit set up by the bank is an approach to a new banking culture altogether and comes out of its desire to do responsible banking.

According to the bank, it chooses to be more sustainable in all its actions, be it in its own operations and resource management, overall business activities including its CSR initiatives. Moreover, the bank encourages its staff for sustainable practices in daily lives, both inside and outside the office and shall gradually de-carbonize its own operations through clean energy sources, reads a press statement issued by the bank.

Conversation

- Info. Dept. Reg. No. : 254/073/74

- Telephone : +977-1-5321303

- Email : [email protected]